Media Reports

Media Reports time:2019-09-12 source:AsianInvestor

AsianInvestor’s annual study of the Asia-Pacific region’s top assets owners shows Chinese investors’ aggregate asset under management (AUM) fell behind that of their peers in Greater China.

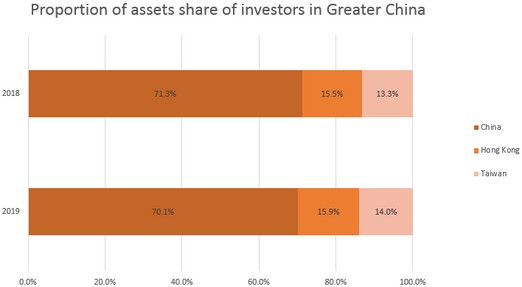

Analysis of the 2019 AI300 data indicates that the AUM growth of Chinese asset owners was less than half the expansion rate seen in Hong Kong and Taiwan. Chinese central bank, insurance and sovereign wealth funds saw their aggregate AUM climb 4.1% year-on-year, falling well short of the 8.4% and 11.6% increases reported in Hong Kong and Taiwan.

The assets growth rate of investors based in the world’s second-largest economy also appears to be lagging the Asia-Pacific average, which stood at 8%.

As a result, China’s share of total regional assets is down on last year (see chart).

Proportion of assets share of investors in Greater China (Source: AI300)

Still, the position of the People’s Bank of China as the biggest asset owner in the Asia-Pacific region remains intact. Its AUM grew by 2.9% to about

$3.1 trillion, more than twice the size of the largest pension fund in the world, Japan's Government Pension Investment Fund.

INSURER BOUNCEBACK

Chinese insurers also experienced growth, with assets growing 14.8% to $1.5 trillion this year. Those in the top-15 in Greater China swelled even more, by 16.8% to $927 billion, with Ping An Life Insurance the fastest grower with a 32% jump in AUM.

Ping An Life didn't immediately respond to AsianInvestor’s queries on the reasons behind this breakneck growth. The insurer’s net profit was up 63.3% year-on-year as of June-end due to a “one-off gain from a tax law change on commission expenses”.

In the individual rankings, Ping An Life rose one place to eighth. China Life Insurance and China Pacific Life Insurance retained the positions as the seventh- and fifteenth-biggest investor in Greater China, respectively.

But that follows a slowdown of the asset growth rate of Chinese insurance companies in previous years after the China Insurance Regulatory Commission restricted the sale of short-term savings products and applied stricter scrutiny of capital injections from insurance company shareholders, said Qian Zhu, Shanghai-based senior credit officer at Moody’s.

The sector has gotten back on its feet since then.

“The premium income has resumed positive growth momentum this year … and the invested assets of Chinese insurance companies are growing, supported by the premium growth, which was recorded at 15% in the first half of 2019 and increased earnings,” Zhu said.

And China's insurers look well placed to continue being the drivers of asset growth due to the still- relatively low levels of insurance penetration across the country.

“Insurance penetration in China is still one of the lowest, especially when you compare it to developed countries,” said Sam Radwan, chief executive of Enhance International, a US-based investment consultant.

“As the population ages at a rapid pace and as social insurance continues to struggle to fill the gap on total medical expenses, the government is hoping for the private sector (insurers) to pick up the slack,” he added. And this will result in a steady and a long-term growth of business on the life insurance side.

DIFFICULTIES AHEAD

Nevertheless, in order to meet that growing demand, insurance specialists warned of potential asset allocation challenges for insurers.

“The biggest challenge I would say comes from the market. Now that the interest rate is so low, it's not easy for Chinese insurers to bring down liability costs when investment yields are pressured,” Zhu said.

Investable assets have also become scarcer, with the number of investable assets and routes to access them limited for insurers.

“China's capital market is less mature to begin with,” Zhu said, with a softening economy, credit risk in the corporate sector in China is also accumulating. And even if insurers were to look overseas for a bigger bucket of opportunities to choose from, they might struggle to find them.

“While technically they can invest abroad, this has slowed down, and [it] will continue to slow down in the short term given the weaker currency and trade tensions,” Radwan said. “While insurers are encouraged to invest abroad in technology, foreign technology companies especially in the US are skittish from receiving Chinese investment.”

In the previous>>Why China insurers should be vigilant over infra debt

next chapter>>返回列表

©2015 Enhance International LLC All rights reserved. Record number: ICP 151003602 -2